Achieving wealth isn’t just about working hard—it’s about adopting a mindset and habits that promote financial independence and stability. While many aspire to financial success, few realize that changing how we think and act plays a significant role. Here’s a breakdown of key differences between wealthy individuals and those who struggle financially, offering insights to help anyone create a brighter financial future.

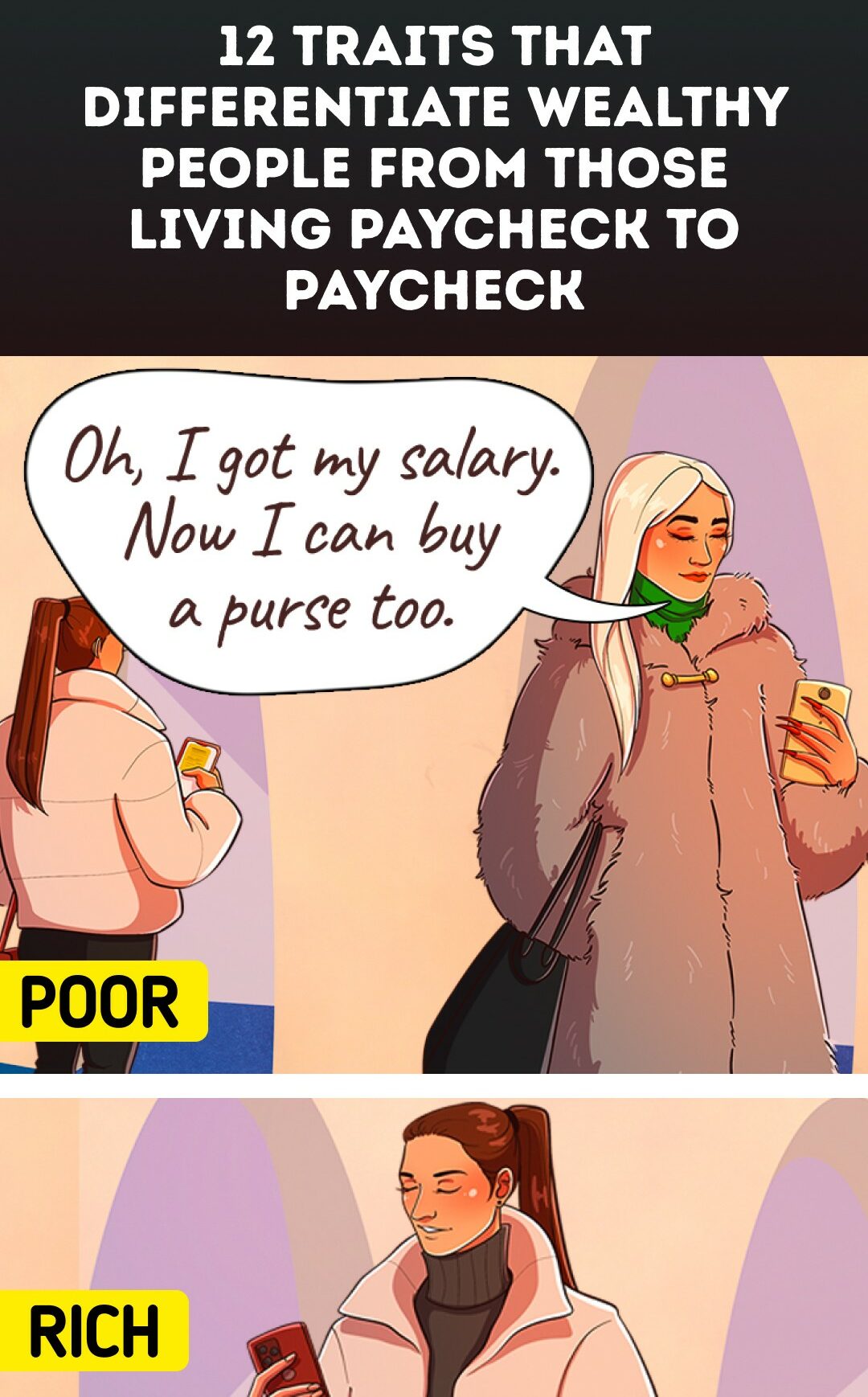

Avoiding Impulse and Unnecessary Purchases

One defining trait of the financially successful is their ability to resist impulse buys. Instead of splurging on fleeting desires, they focus on thoughtful, intentional purchases that align with their goals. This doesn’t mean they never treat themselves—it simply means they prioritize long-term rewards over short-term satisfaction. On the other hand, those living paycheck to paycheck often fall victim to impulse spending, which can lead to financial instability.

Video:

Quality Over Quantity: A Smarter Work Ethic

Contrary to popular belief, working endless hours doesn’t guarantee wealth. Wealthy individuals focus on optimizing their time and efforts, prioritizing tasks that yield the most significant results. This allows them to create a balance between work, personal growth, and hobbies, leading to a more fulfilling life. Those who focus solely on clocking in extra hours often feel stuck, with little time to strategize or pursue opportunities for advancement.

Building a Financial Safety Net

Wealthy individuals prioritize saving a portion of their income for emergencies or investments. This “safety cushion” offers peace of mind during tough times. In contrast, those struggling financially often rely on debt when unexpected expenses arise. Adopting a “save first, spend later” mentality can make a significant difference in achieving financial security.

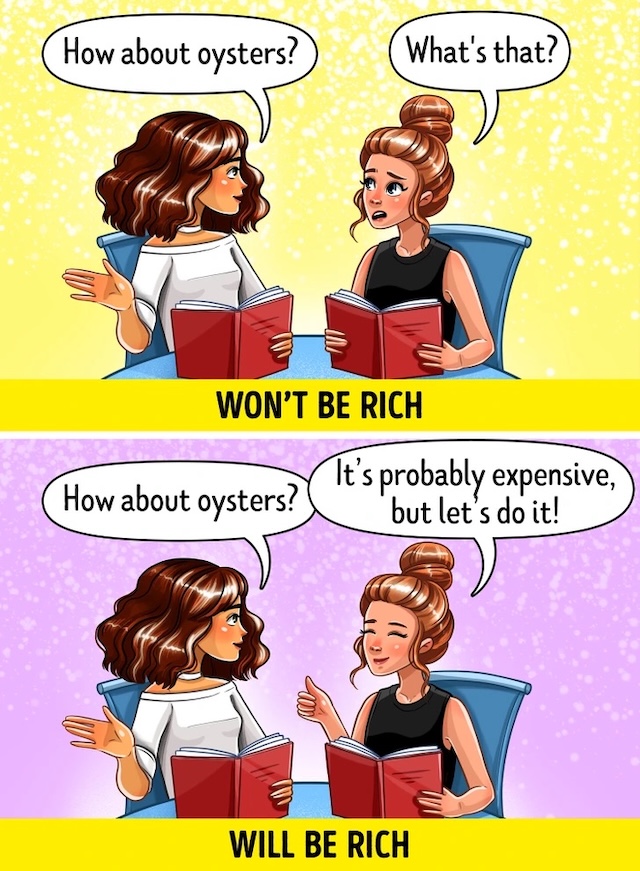

Embracing Calculated Risks

Playing it safe may seem comfortable, but it rarely leads to financial breakthroughs. Wealthy individuals understand the importance of calculated risks, whether through investing, starting a business, or exploring new career paths. Meanwhile, those who avoid all risks often find themselves stuck in their current situation, unable to seize opportunities for growth.

Staying in Control of Their Money

Successful people know exactly where their money goes. They meticulously track income, expenses, and savings to ensure every dollar is accounted for. This financial awareness empowers them to make informed decisions and prepare for the future. On the other hand, individuals who lack control over their money often find themselves in a cycle of stress and uncertainty.

Setting Clear Financial Boundaries

Wealthy individuals understand the value of saying “no.” Whether it’s turning down unnecessary expenses or declining opportunities that don’t align with their goals, setting boundaries helps them stay focused. Conversely, those who overextend themselves financially or personally often struggle to maintain stability.

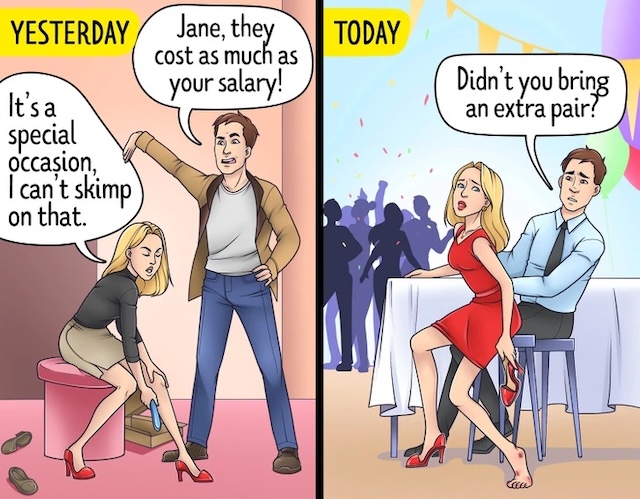

Avoiding Debt-Fueled Indulgences

Using credit to fund vacations or luxury items is a hallmark of poor financial habits. Wealthy individuals prioritize saving for these experiences rather than accumulating debt. This approach not only protects their financial health but also allows them to enjoy their purchases without the burden of repayment.

Investing in Continuous Learning

Financially successful people never stop learning. They invest time and resources into acquiring new skills, expanding their knowledge, and staying ahead in their industries. This commitment to growth keeps them competitive in a rapidly changing world. In contrast, those who avoid learning new things risk falling behind and limiting their earning potential.

Managing Time Wisely

For the wealthy, time is a valuable asset. They often delegate household chores or hire help to free up time for personal development, hobbies, or strategic planning. In contrast, those who spend most of their free time on mundane tasks may miss opportunities to improve their lives and finances.

Keeping Their Goals Private

Successful individuals understand the power of discretion. By keeping their plans and aspirations private, they avoid unnecessary distractions and criticism, allowing them to stay focused. Sharing goals too early can invite doubt or unsolicited advice, derailing progress.

Practicing Mindful Spending

The wealthy approach spending with caution, focusing on value and necessity rather than indulgence. They avoid purchasing items they don’t need or won’t use, channeling their resources toward investments that yield long-term benefits. On the other hand, impulsive spending often leaves others financially stretched.

Minimizing Waste

Wealthy individuals recognize the importance of resourcefulness. By planning meals and purchases carefully, they reduce waste and maximize their budget. This not only saves money but also reflects a responsible and sustainable lifestyle.

Conclusion: Adopting Wealthy Habits for Financial Freedom

Building wealth isn’t just about earning more money—it’s about changing how you think, spend, and save. By adopting habits like mindful spending, continuous learning, and calculated risk-taking, anyone can take steps toward financial independence. It’s never too late to reframe your mindset and start building a stable and prosperous future.