In today’s world of contactless payments and digital wallets, it’s hard to imagine a time when processing a credit card was a lengthy manual process. But for decades, every business had to rely on one simple tool to get transactions completed: the vintage credit card imprinter. This little device, often affectionately called a “knuckle buster,” was the backbone of retail transactions before the age of electronic card readers. It was not just essential; it was a must-have for any business looking to accept credit cards as a form of payment.

The Rise of Credit Cards and the Birth of the Imprinter

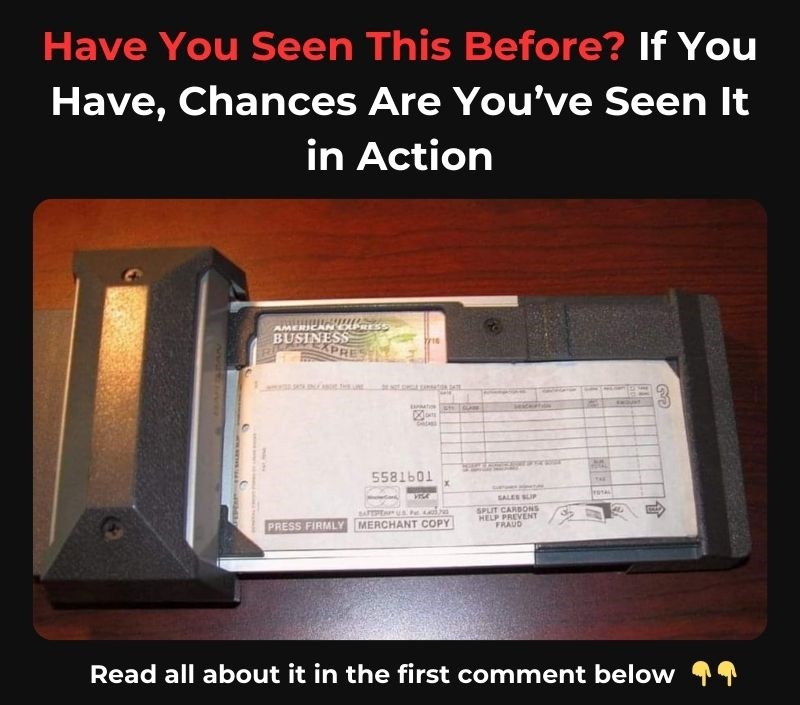

As credit cards began to gain popularity in the 1950s and 1960s, businesses needed a way to process payments without a direct connection to banks or payment networks. The vintage credit card imprinter was the answer to this need. Simple and mechanical, it worked by making an impression of the raised details on a credit card onto carbon paper, which created a physical copy of the cardholder’s information.

This process might seem archaic now, but it was a revolutionary system at the time. For the first time, businesses could accept credit cards without needing to rely on phone calls or telegraphic methods to verify payments. The imprinter allowed them to simply take a paper copy, which would later be submitted for processing. It was efficient, reliable, and widely adopted by businesses everywhere.

How the Vintage Credit Card Imprinter Worked

Using the vintage credit card imprinter was relatively simple, but it required manual effort. The merchant would place the customer’s credit card into the designated slot on the imprinter. On top of the card, they would lay a multi-part carbon paper slip, which recorded the customer’s card details and purchase information.

Once everything was in place, the merchant would slide the handle from one side of the machine to the other, pressing down hard enough to imprint the raised card numbers onto the paper. This is why it earned the nickname “knuckle buster” – merchants often had to apply significant force, leading to sore knuckles after repeated use.

The imprinted carbon slip would be separated, with one copy given to the customer, and the merchant would keep a copy to send to the bank for processing. While this process took time and effort, it was still faster than previous methods and allowed for credit card payments to be taken at locations without electronic systems.

The Impact on Retail and Small Businesses

For small businesses, the vintage credit card imprinter was a game changer. Before its introduction, accepting credit cards was often seen as something only large businesses could handle, due to the complexity of processing payments. With the imprinter, even the smallest shop could quickly and efficiently accept credit card payments, opening up new opportunities for sales and customer convenience.

This small device bridged the gap between businesses and the growing world of consumer credit. It allowed for credit transactions to be made anywhere – whether it was at a market stall, a gas station, or a luxury department store. Even without an internet connection or phone line, a business could take a customer’s credit card and process the transaction later, making it highly versatile and essential.

A Tool for the Times

As technology evolved, the vintage credit card imprinter remained a staple for several decades. Even into the 1980s and 1990s, many businesses used it as a backup system, especially in areas where electronic terminals weren’t reliable or widely available. Many merchants kept them on hand as a fail-safe in case electronic systems went down or during power outages.

What’s fascinating about the imprinter is how it provided a transitional bridge from fully manual payment methods to the automated systems we rely on today. It represents a time when the world was rapidly modernizing, but still deeply rooted in mechanical, hands-on solutions.

Fun Facts and Lesser-Known History

While the vintage credit card imprinter might seem like a straightforward tool, there are a few fun facts about its history that make it even more interesting:

- Universal Design: The imprinter could be used with any credit card, as long as it had raised numbers. This universal design meant that merchants didn’t need different machines for different cards, making it incredibly versatile.

- Multiple Copies: The carbon paper slips often came in triplicate, allowing the merchant to keep one copy, send one to the bank, and give one to the customer. This was an early form of fraud prevention, as all parties had a record of the transaction.

- Surprising Longevity: Even after electronic payment systems became common in the 1990s, many businesses continued to use the imprinter as a backup for several more years. In fact, you might still find them in use in some parts of the world today!

- The Sound of Commerce: For many people, the loud “clunk-clunk” sound of the vintage credit card imprinter was synonymous with making a purchase. This sound became part of the retail experience for decades, much like the sound of a cash register.

The Legacy of the Vintage Credit Card Imprinter

Though the vintage credit card imprinter is mostly a relic of the past, its legacy lives on. It played an integral role in the development of modern payment systems and helped pave the way for the credit card revolution. Without this simple, effective tool, credit cards may not have become as ubiquitous as they are today.

Looking back, it’s easy to see why the vintage credit card imprinter was a must-have for businesses everywhere. It was a tool of its time, perfectly suited to the needs of a growing consumer culture. Today, it stands as a nostalgic reminder of how far we’ve come in the world of payment processing, and how even the simplest inventions can have a lasting impact.

In the fast-paced, digital world we live in now, the vintage credit card imprinter serves as a fascinating piece of history. It reminds us that progress often comes in small steps, and sometimes, those small steps are just as important as the giant leaps forward.