Let’s face it: teaching teens about money feels like trying to juggle flaming swords—chaotic, risky, and slightly terrifying. One minute, they’re carefully saving for that new pair of sneakers, and the next, they’ve spent every penny on snacks, subscriptions, and the latest tech gadget. It’s enough to make any parent want to throw in the towel. But here’s the thing: if we don’t teach them about managing money now, they’ll be left scrambling later when it truly matters.

The good news is that you don’t need to be a financial guru to raise a money-savvy teen. You just need to apply some smart strategies—and a lot of patience—to let them learn through experience. In this guide, we’ll dive into eight practical, effective ways to help your teen develop the financial skills they’ll need for adulthood. These tips will not only give them the independence they crave but also equip them with lifelong money lessons that’ll serve them well.

1. Give Them a Structured Allowance With Boundaries

Teens are eager to gain independence, and money provides the perfect opportunity for them to do so. By giving them a weekly or monthly allowance, you teach them how to prioritize their spending and make decisions about what’s important. But just handing over cash won’t do the trick. You’ll need to set clear rules that guide them.

For example, establish a system where the money is allocated for specific expenses like entertainment, clothing, and personal items. Let them decide how to spend it, but remind them: when it’s gone, it’s gone. Want to make it even more engaging? Let them earn bonuses by completing extra chores or achieving good grades. This approach not only teaches financial responsibility but also shows them the value of working for what they want.

If your teen refuses to clean their room unless paid, consider charging them for other household services, like laundry or transportation. It won’t take long for them to realize that “free” isn’t really free!

Want to dive deeper into practical money tips for teens? Check out this video that’s packed with valuable advice to help your teen become money-smart!

2. Let Them Handle Their Own Clothing Budget

One of the most effective ways to teach teens financial responsibility is through back-to-school shopping. Rather than controlling every purchase, give your teen a set clothing budget and let them decide what to buy. This experience is often a great way to test their financial judgment.

If they blow their entire budget on brand-name sneakers and can’t afford a jacket, they’ll learn firsthand the consequences of their choices. And that’s the point! It teaches them to prioritize needs over wants, compare prices, and make thoughtful purchasing decisions. While it’s okay to offer guidance along the way, let them feel the impact of their decisions. The lessons learned in real-life scenarios are far more valuable than any lecture you could give.

3. Introduce Simple Budgeting Skills Early

Budgeting might sound boring, but it doesn’t have to be. By introducing simple budgeting concepts at an early age, you’re helping your teen develop essential skills for managing their money as they grow older. Start with something straightforward, like the 50/30/20 rule, which divides income into three categories:

- 50% for essentials (food, transportation, school needs)

- 30% for fun (hobbies, dining out, entertainment)

- 20% for savings (short-term or long-term goals)

Discuss the difference between “needs” and “wants.” It’s an eye-opener when your teen realizes that the latest $90 hoodie isn’t exactly a necessity! Get them involved by letting them see family budgeting decisions, such as utility bills or grocery shopping. This not only helps them understand how budgeting works but also makes it a more tangible and relevant experience.

To make things clearer, check out this video on how to manage your money using the 50/30/20 rule—it’s a game changer!

4. Help Them Set Exciting, Reachable Savings Goals

Telling teens to “just save” is unlikely to get much traction. But if you can tie savings to something they’re genuinely excited about, like a concert ticket, new earbuds, or a weekend trip with friends, you’ll have their attention. When savings become part of something they’re looking forward to, the process becomes much more engaging.

Help them calculate the total cost of the item or event, break it down into weekly savings goals, and track their progress together. Use apps or even a simple notebook to keep track of their savings. To make the savings feel more meaningful, set up a separate savings account they can’t easily access. By locking the money away—whether digitally or physically—you’re reinforcing their commitment to their goals.

5. Teach the Power of Patience With Delayed Gratification

In today’s world of one-click shopping and instant deliveries, practicing delayed gratification has never been more important. Instant gratification is a financial pitfall that many teens fall into, often resulting in buyer’s remorse or impulsive spending.

Teach your teen to wait before making big purchases. The next time they ask for something pricey, encourage them to hold off for a week. Ask them to think carefully about whether they still want it after a little time. If they do, they can use their own money to buy it. If not, they’ll have saved themselves from unnecessary spending. This practice strengthens their decision-making skills and builds patience, which will serve them well in all areas of their life.

6. Let Them Fail (And Learn) Without Rescue

One of the most difficult parts of parenting is watching your teen make poor financial choices. However, stepping in to rescue them every time they mess up isn’t helping them learn. Mistakes are an important part of the learning process.

If they blow their birthday budget on pizza and end up with nothing left for a gift they wanted, let them feel the consequences. Once the lesson lands, talk it through together. Discuss what they would do differently next time. You can also set challenges, like having them plan a day trip on a budget or manage the grocery shopping for a week. Giving them responsibility—and letting them learn from the results—is one of the best ways to build their financial acumen.

7. Use Games and Apps That Make Money Fun

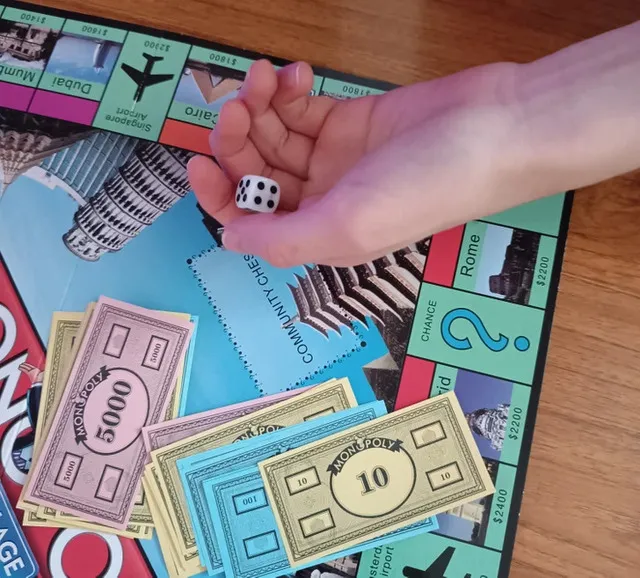

Money doesn’t have to be all spreadsheets and stress. In fact, you can make learning about money fun through games and apps. Classic board games like Monopoly or The Game of Life introduce teens to the concepts of budgeting, saving, and investing in an interactive way.

There are also financial apps like BusyKid and Greenlight, which offer hands-on experiences for teens to learn about managing allowances, making investments, and understanding financial concepts in a low-pressure setting. Even a simple digital piggy bank or allowance tracker can help teens visualize their spending and saving. The more they interact with money in a playful, low-stress way, the easier it will be for them to develop a positive relationship with it.

8. Use “Loans” to Teach Accountability

Sometimes, a teen might run into a situation where they need a little extra cash—whether it’s to buy a new phone or cover an unexpected expense. Offering a small loan can be an excellent way to teach them about borrowing and accountability.

However, make sure you set clear terms. Establish a repayment schedule, and if you want to add a little more learning, charge symbolic interest. This experience will teach your teen the real-world consequences of borrowing money, including the need for responsible repayment and understanding debt.

Conclusion: Raising Confident, Financially Savvy Teens

Teaching your teen about money isn’t about handing them a financial rulebook and hoping they figure it out. It’s about giving them the tools, the freedom, and the opportunity to learn through experience. Over time, as they make decisions, face consequences, and celebrate successes, they’ll develop the confidence to handle money wisely in adulthood.

Your job isn’t to manage their money for them but to guide them along the way. Ask questions, offer feedback, and let them take ownership of their financial journey. Because nothing builds confidence like learning how to earn, spend, save, and succeed—all on their own terms.

By following these eight smart strategies, you’ll help your teen become financially savvy without losing your mind in the process. And who knows? They might even thank you for it someday!