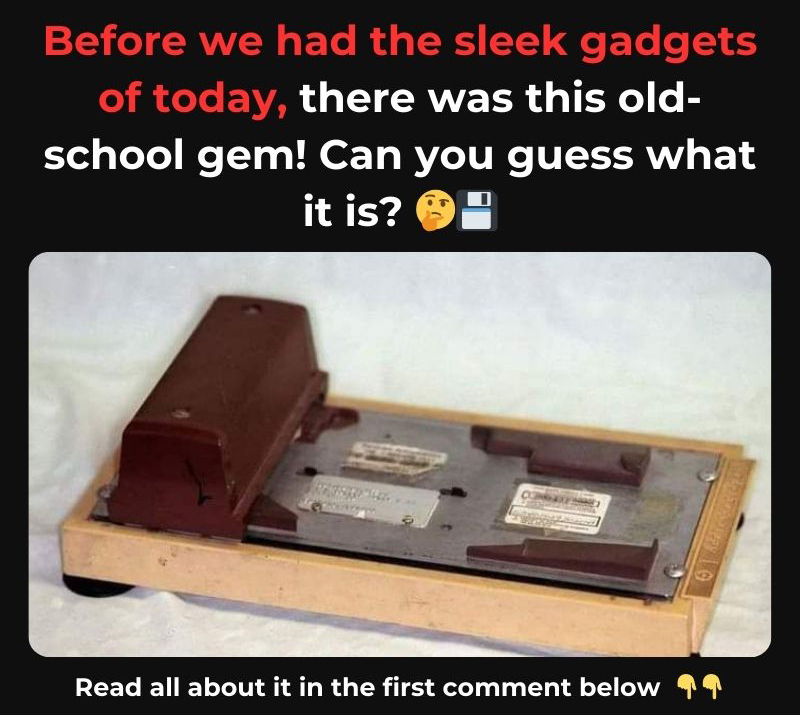

Do you remember the days when swiping a credit card was an exciting and satisfying experience? Before the world went digital with tap-and-go payments and mobile apps, the credit card swiper was a must-have tool that every merchant and business owner relied on. These mechanical devices, simple in design but revolutionary in function, helped facilitate countless transactions and change the way people paid for goods and services. Let’s take a look back at how the credit card swiper became a staple of commerce, and how it played a pivotal role in the payment systems we use today.

The Birth of the Credit Card Swiper: From Imprints to Electronic Transactions

The concept of a credit card swiper emerged in the early 20th century, but its significant breakthrough came in the 1950s with the advent of the first magnetic strip cards. Before the magnetic stripe, credit card transactions were processed manually, where both the cardholder and merchant had to rely on paper-based systems for validation. This made credit card payments time-consuming, and often prone to errors.

In 1958, American Express introduced the first-ever magnetic stripe on a credit card, marking the birth of the credit card swiper. This magnetic stripe contained essential information, such as the cardholder’s account number and other data that could be easily read by a device. With this innovation, swiping a card became a fast, efficient, and secure way to process payments. The credit card swiper was born out of necessity—a tool that simplified transactions and sped up the payment process for both businesses and customers.

Video

Watch the video Ode to the Credit Card Imprinter to take a nostalgic look at this once-essential piece of technology.

The Functionality of the Credit Card Swiper: How It Worked

If you’ve ever used a credit card swiper, you know that the process was surprisingly simple but effective. The device consisted of a small, sturdy frame with rollers and a slot for the card. The merchant would place the customer’s credit card into the swiper, which would then pull the card through the rollers. These rollers would create a physical impression of the magnetic stripe on the card, transferring the necessary information onto a carbon paper receipt or a duplicate slip. This way, both the customer and the business could have a copy of the transaction for their records.

The swiping action was a signature part of the experience. It made a satisfying sound as the card moved through the device, and the transaction felt complete as the merchant handed back the card along with the signed receipt. For many, it was a regular and familiar part of shopping, dining, and even traveling.

The credit card swiper was used widely in a range of businesses, from small mom-and-pop shops to large hotels and restaurants. It offered a convenient alternative to cash payments and paved the way for credit card usage to become mainstream.

The Rise of the Credit Card Swiper in the 1980s and 1990s: An Essential Tool for Merchants

In the 1980s and 1990s, the credit card swiper became a ubiquitous tool in every business that accepted credit cards. If you were a small business owner during this time, chances are you couldn’t run your operations without one. The swipe machines made processing payments not only faster but also more reliable. Before this tool, businesses would need to verify credit information manually, which was cumbersome and often led to errors.

One of the most iconic features of the credit card swiper was the receipt it generated. The carbon copies of receipts became a staple for record-keeping, allowing both merchants and consumers to keep track of their spending. This was long before the advent of digital receipts or email confirmations, and the physical receipt was often seen as an essential document for proving a transaction took place.

Moreover, the device was relatively simple and inexpensive, which made it accessible for a wide range of businesses. Whether you were at a gas station, a department store, or a restaurant, the credit card swiper was likely the tool being used to process your payment. It became so ingrained in daily commerce that it was almost unnoticeable—a silent hero of the transaction process.

The Decline of the Credit Card Swiper: Digital Innovation Takes Over

As with many technologies, the credit card swiper saw its decline as the world moved toward more advanced digital payment systems. With the rise of chip cards in the early 2000s, followed by the introduction of contactless payments, the swiper became somewhat obsolete. Modern point-of-sale (POS) systems began to incorporate more sophisticated technology, including EMV chip readers and mobile payment options like Apple Pay and Google Wallet. These newer systems offered greater security and convenience for both merchants and consumers.

Despite its decline, the credit card swiper will always hold a special place in the hearts of those who remember using it. It was part of a generation that saw the transition from paper checks to electronic payments, and it was instrumental in making credit card transactions easier and faster for everyone involved.

Fun Facts About the Credit Card Swiper That You May Not Know

The Swipe Was a Ritual: For many people, the sound of the card swiping through the machine became synonymous with spending. It was a brief yet satisfying moment, a sign that the purchase was complete.

Impressions Were a Backup: Before the digital age, if a credit card transaction couldn’t be processed electronically (such as in areas with limited connectivity), the credit card swiper would still produce a physical imprint of the card’s details. This backup was crucial for ensuring the transaction could still be processed later.

Portable Swipers Existed: There were even portable versions of the credit card swiper, which were often used by traveling salespeople or small business owners who didn’t have a fixed location. These mobile swipers were compact and could easily fit into a briefcase, making it easier for merchants to process payments on the go.

Magnetic Stripes: The magnetic stripe technology that powered the credit card swiper remains one of the core components of credit card transactions to this day. Though newer technology like EMV chips have largely replaced it, magnetic strips are still used in many places, particularly for debit cards and loyalty cards.

Swipe vs. Chip: Interestingly, even though chip cards are now the standard, many people still associate the “swiping” motion with paying by card. In fact, swiping a credit card used to feel much faster and more intuitive than inserting a chip card into a reader, a sentiment that many still hold today.

Why the Credit Card Swiper Will Always Be Part of Our History

The credit card swiper may seem like a relic of the past, but its legacy lives on in the systems we use today. Before digital payments became the norm, it was the tool that helped usher in the modern era of credit card usage. It simplified the payment process and made it accessible to businesses and consumers alike.

For those who remember the days of manually swiping a card, the credit card swiper holds a sense of nostalgia. It was an everyday object that connected us to the growing world of electronic payments. And although we’ve moved on to faster and more secure methods of payment, the impact of the credit card swiper remains undeniable.

Conclusion: The Legacy of the Credit Card Swiper in Our Modern Transactions

In a world where digital payments are the standard, it’s easy to forget how far we’ve come. The credit card swiper was one of the stepping stones that helped us transition from a cash-only society to one where credit cards and digital payments are integral to everyday life.

As we look back, it’s clear that the credit card swiper was not just a piece of technology—it was a tool that changed how we interacted with money. Whether we were shopping at a store, paying for dinner at a restaurant, or making travel arrangements, it was there, swiping away, making transactions easier and more efficient.

While technology continues to evolve, the credit card swiper will always remain a part of history, symbolizing the birth of modern electronic payments and the shift toward a cashless world.

Video

Watch the video 4850 Flatbed Operating Instructions for a clear and detailed guide on how to use this flatbed scanner effectively.